Transfer Money to India | Best Ways to Send Money Home

Many of my followers always ask me How I transfer Money to India from Germany? What are the best ways to send money home to India? Mostly they are concerned about which platform gives the best rates to send money home.

So I thought of covering this question in this blog of money transfer to India from Germany. If you are looking for a comparison of all the existing secure methods of transferring money to India then you have landed in the right place.

Why do you actually need an application to transfer money?

Now this question will always be in your mind when you are thinking about transferring money to India from Germany

Why can’t I use my bank account to transfer the money? The answer is quite simple. They will charge you high foreign exchange fees and by doing this ultimately you will get comparatively less amount in your Indian bank account.

This is the reason why even I have been using different applications to send money home to India and most of the time I try new applications so as to get the free transfer limit to India. Shshssh!! This is a benefit of being a first-time user of that payment company. Most of the companies allow first-time users to send money to India at zero fees.

What all applications can I use to transfer money to India?

Well, there is a handful of them in the market and I’ll be going through with the couple of them that I have tried and will make sure to share the current rate of them so you can understand how much they actually charge you for sending money to India from Germany or any part of the world.

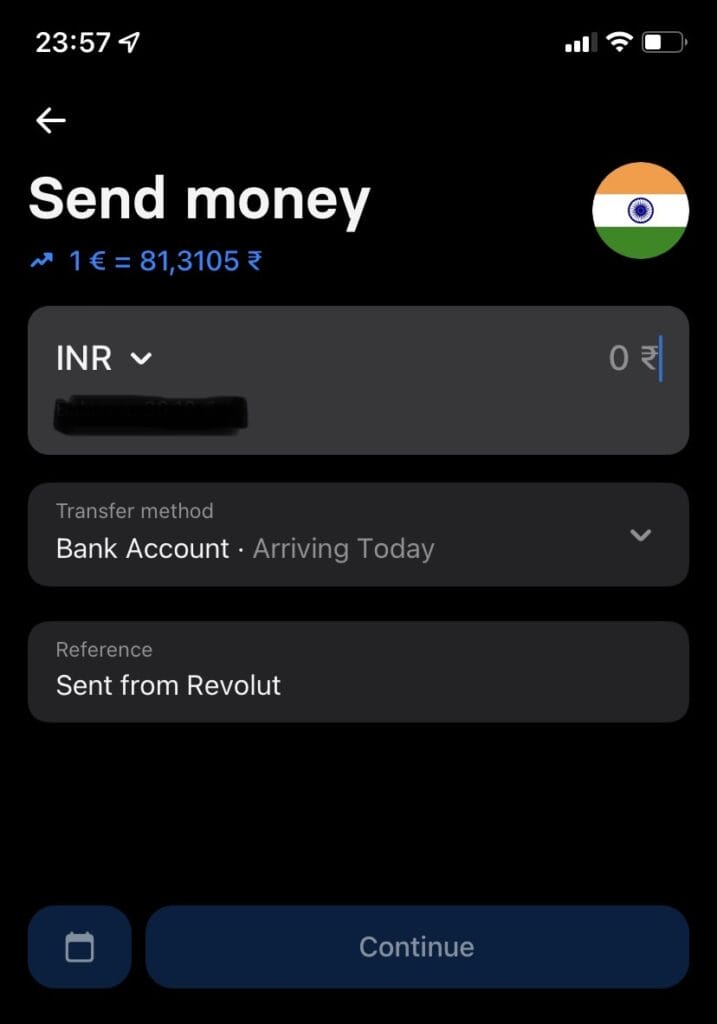

1. Revolut

Revolut is a bank where you can open your account online from your home. The standard plan is free of cost, so you can keep this account as a side account to make payments when you are travelling in another country. They also provide you with a free Debit Card.

For sending money home, they give you the best rate possible for transferring up to Є1000. Once this limit is reached, a fair usage fee of 0.5% is applied. Please note if you are making a transfer during the weekend, then additional weekend transfer charges may apply. You can make bank transfers to 200+ countries.

For sending €1000 from Germany, recipient in India will get ₹81,310 as per the rates on 15.08.2022. Managing your money would be so much easier if you had Revolut. Sign up with my link : Register Here

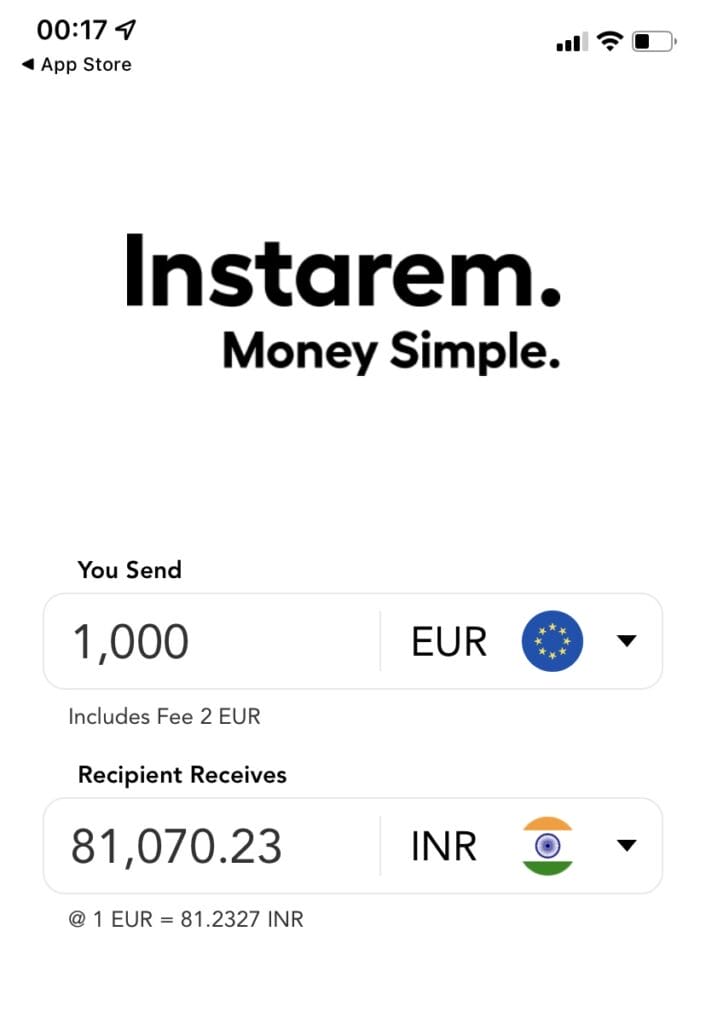

2. Instarem

Instarem is a great option to send money home. It provides fast, convenient and cost-effective services to transfer money globally. They offer great forex rates with low transfer fees without any hidden costs. Instarem has been simplifying money and payments for students and ex-pats for some years now.

If you choose to try this application you can use my referral link: Register Here

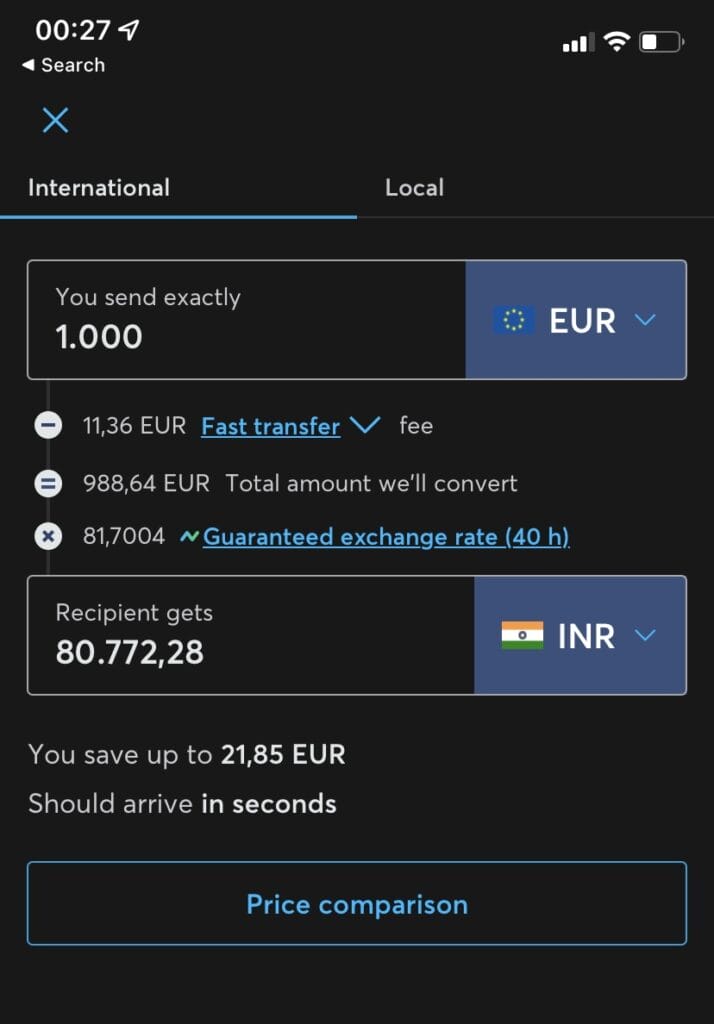

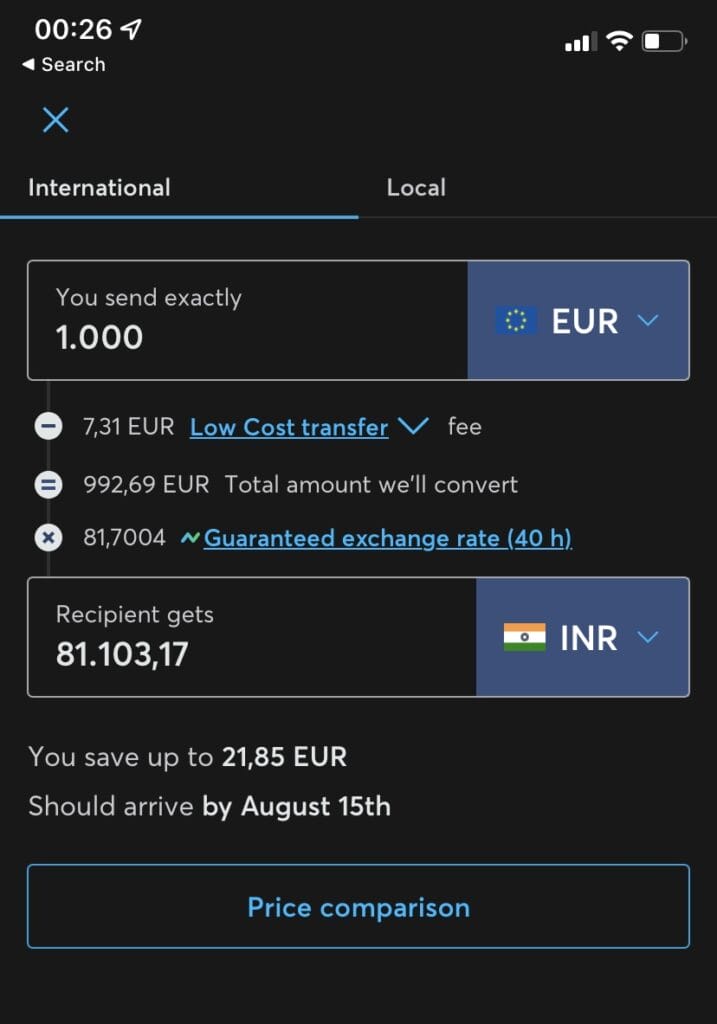

3. Wise (Formerly known as Transferwise)

Wise or Transferwise is one of the trustworthy names in the market for sending money to India from any part of the world.

Wise is also one of the fastest ways of sending money to India because they do offer a quick transfer mode as well but in this case, they charge more fees. Normally whatever amount you are sending gets credited to your Indian bank account in 1 business day.

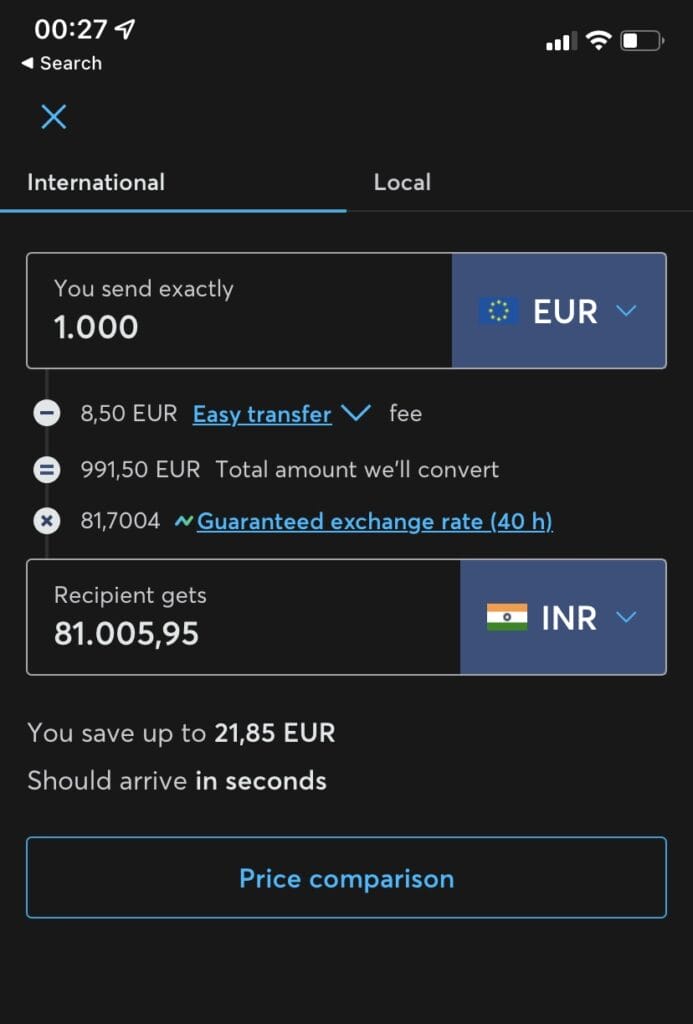

If you want to send money by Wise below is the cost breakage for that for 15.08.2022 for sending 1000 Euro to India. I have selected the Low-Cost Transfer because this is the cheapest way to send money to India.

Below are the fees in Euros charged by Wise for sending 1000 Euro to India from Germany.

| Fast Transfer | Low-Cost Transfer | Easy Transfer | |

| Wise | € 11.36 | € 7.31 | € 8.50 |

4. Rewire

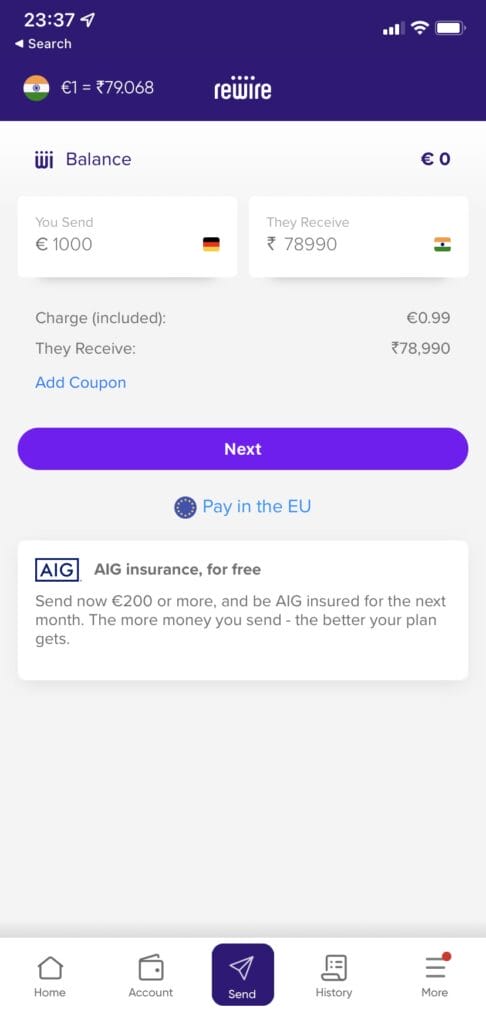

Rewire is another interesting application to transfer money to India from Germany or any other part of the world. I used this application once as well and I was really surprised when I got the money in my Indian bank account in just an hour which was lightning fast for me.

If you are looking forward to try this application then if you will use my link to signup you will get 3 Free Money Transfer to India from Germany.

Now let us talk business, below is the sample for sending 1000 Euro to India on 22.08.2022 using Rewire.

So normally rewire gives less rate for the transfer but since their fees is comparatively less ultimately you get more money in your bank account.

5. Skrill

I am really not sure why people don’t talk about Skrill when someone asks How to Transfer Money to India from Germany. Because I found this application really awesome with a perfect rate of transfer and above all it is free.

Yes you heard it right, Transferring money to India using Skrill is free but just so that you are aware of it, Normally it takes around 2-3 working days for you to receive the money in your Indian bank account.

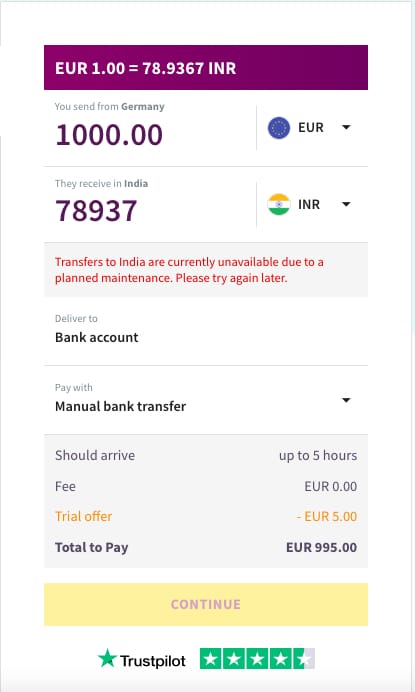

So if you want to transfer 1000 Euros from Germany to India then below is the amount you will get in the Indian bank account and you pay Zero Fees while using Skrill.

6. Remitly

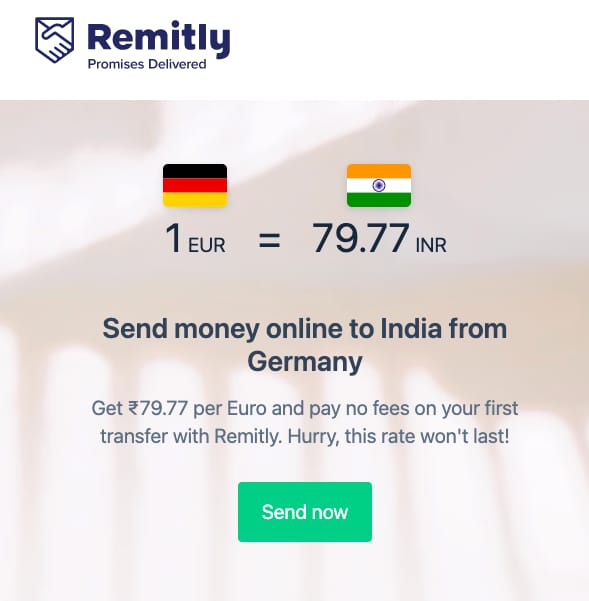

Remitly is a nice application for sending money to India from Germany is Remitly and if you are a first-time user of this application then you will get a 1-time free usage of sending money to India.

Now when you are using this application for the first time they offer a really sick rate of transfer and the fees charged by them is Zero for the first transfer.

So let us suppose I am a new user and I want to transfer 1000 Euro to India then below is what I will get in the Indian bank account.

But the above rate is only for the first-time user, If you are a normal user of this application then you will get something like the below in your bank account

| App Name | Transfer Amount | Rate | Fees | Amount Received |

| Remitly | 1000 | 79.77 (22.08.2022) | 0 | 79,777 |

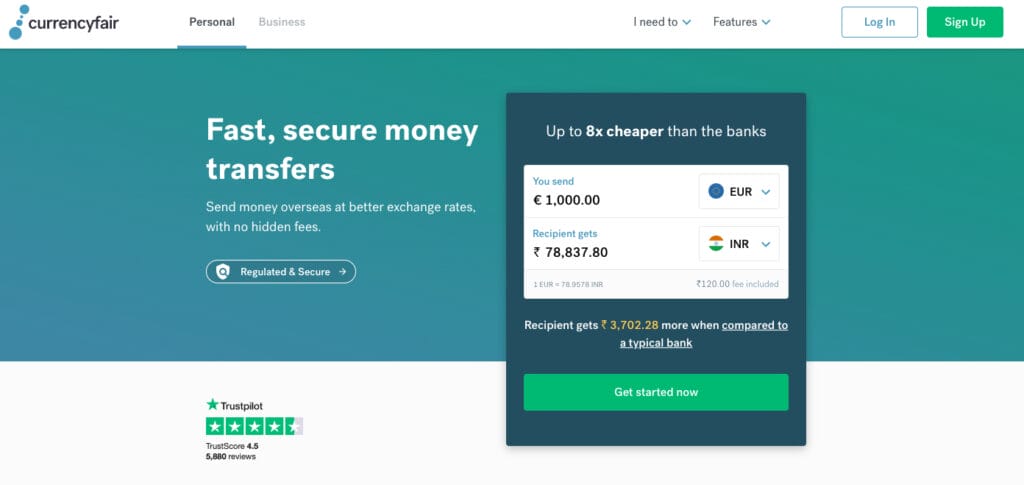

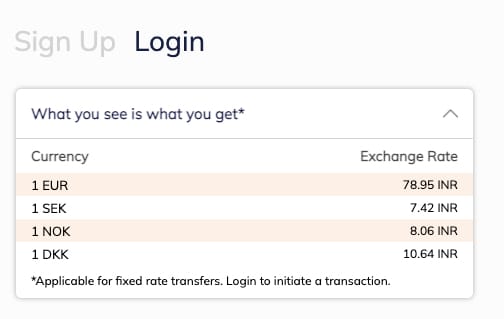

7. Currencyfair

Let’s talk about Currencyfair a really interesting application which offers you around 10 free transactions to transfer money to India from Germany. I have personally not tried it yet to be honest, but the overall reviews are great.

And the rate of transfer is absolutely at par with all the options which I shared above so you have to try that out if you want.

8. ICICI Bank Money2India

Now if you are a fan of brands then you would really want to check about the new way of sending money to India from Europe/Germany ICICI bank options Money 2 India.

The signup process for this is pretty simple and you will get a really comparable rate for transfer. Since this is a trusted well renowned bank in India, you can also give it a try.

9. XE

XE was something new which came out in the research while writing this post and the rate of interest offered by them was also really good so this had to be added to our list of applications or websites to use to transfer money to India from Germany.

10. Transfer Go

If you are choosing to send money using Transfer Go then signing up to this website would hardly take a minute for you. The transfer fee and day taken for transfer is similar to other modes of money transfer.

11. Azimo

Azimo is another application which you can use to transfer money to India is Azimo. They offer you 1 transaction free of charge if you are using this application for the first time.

12. World Remit

I really liked the UI interface of this website and the signup process was lightning fast. The interesting thing about this is that if you are joining via your friend’s link then you end up getting 25 Euro extra in your bank account.

So who doesn’t love extra money earned through referrals?

The most interesting part of this website was the lightning-fast speed of the transfer. They charge around 1.99 Euro and the transfer happens within minutes.

13. Paysend

If you are choosing Paysend as your application for sending money to India from Germany then one thing to note is that with the normal plan you get the limit of 1000 Euro to be sent every month. In this case, you don’t have to share your personal documents with them.

If you choose to upgrade then you have to submit the personal documents and once the Paysend teams verified it then after that you can send money for higher limits.

14. Western Union

I think we all have grown up seeing Western Union advertisements on television. Let us talk about Western Union a much-known name to the wider audience for transferring money worldwide.

Hence, last but not the least, this is also a great option to transfer money from Europe to India or Germany to India

Which application/Website is the best to Transfer Money to India?

Now as you have seen the comparison of the rate offered by these websites and the amount received in your Indian bank account. You should take a deep breath and download these applications to test on your own. I hope you are able to find amazing offers and transfer money from Germany to India or Europe to India.

FAQs on Sending Money to India from germany

How long does it take to send money to India from Germany?

1 Business Day, the financial services have grown drastically over the past few years and now the payee can receive the money within the same day or one-two business day only

How can I transfer money to India in 4 steps?

1. Open the money transfer app you want to use.

2. Enter Payee details to whomsoever you are sending.

3. Click on Transfer Money and enter how much money (Euros) you want to send. You will also see how much money the payee will get in INR.

4. Check the fees included in the transfer and click on send.

Can I use my salaried bank account in Germany to send money home?

Yes, you can also send money from your salaried bank account, you will have to check the official website of your bank.

How much money can you send abroad from Germany?

Transactions over 12,500 euros are subject to the reporting obligation according to the German foreign trade and payment law.

Below are some more interesting posts for Expats and students living in Germany: